Money Talk with Financial Coach Nicholle Hartman

Tips for taking charge of your future fortunes

Financial Coach Nicholle Hartman often begins a first meeting with a new client by asking, “Do you know who your fifth great-grandfather was?” In other words, your great-great-great-great-great grandfather. His name, his history, where he was born, how he lived, where he died.

Hartman says, “If you’re Black, the answer is most likely no,” unless of course your family tree has been mapped by Dr. Henry Louis Gates, Jr. “I ask the question rhetorically, to illustrate one thing: most wealthy white people traditionally have generational knowledge, and knowledge of their generational wealth. Most Black people don’t, including wealthy Black people.”

This lack of legacy is at the heart of financial difficulties typically experienced by Black people. Hartman calls this a person’s “money DNA.” Like genetic DNA, this deeply embedded coding dictates the initial template of how we feel about and act around money. And like genetic DNA, money DNA can be reprogrammed by the equivalent of gene therapy, namely by adopting new beliefs and practices that foster growth.

She cites the example of life insurance: Black people buy more life insurance than white (and other) people, with the understanding that doing so creates an immediate estate for future generations. The life insurance policies taken out by Black people are generally too modest to accomplish this as hoped.

On the one hand, could anything be colder and harder than cold, hard cash? Yet Hartman reveals that for most of us, money is surrounded by Feelings with a capital “F.” “How we relate to money says a lot about how we were brought up,” she says. “Often, for Black people, there is a lot of emotion and trauma around a lifetime lack of financial stability.”

The way that this trauma often manifests is in extremes. Fear of “not-enough-ness” often results in a sort of paralysis, where the person hesitates to part with even a penny, and can’t enjoy their assets. “One positive aspect of this tendency is that this person is very thrifty, and tends to save money consistently,” she says. “Even if it’s under the mattress, cash saved is a good thing.” The other extreme is the person who spends as fast, or faster, than they earn. This tendency may arise from feelings of unworthiness, causing the individual to turn over the cash as fast as possible, in a seemingly panicky attempt to get rid of it. “This would fall under the heading of compulsive spending,” notes Hartman. “Not only does this person burn through their cash, but when the credit cards get involved, we’re off into a whole other set of potential issues.”

A common result, she explains, is encountering women in midlife or later who are left adrift when their spouses pass on, not necessarily without any assets, but without a strategy or a plan about how to create a comfortable life for themselves in the later decades of life. “The national statistics about American women and money say it all,” according to Hartman. “Only 49 per cent of women contribute to their retirement plans. That means that 51 per cent do not. An estimated 57 per cent depend upon Social Security as their sole source of income after retirement age, and 11% of women aged 65 and older are considered ‘poor,’ meaning that they live at or below the Federally recognized poverty-line. And, I have to say, these statistics probably don’t accurately reflect the status of Black women in this age group, where I know from lived experience that the numbers are far more dire.”

Does any of the above resonate with you? You may well need to play catch-up, and you may need to come up with some creative compromises. Yes, downsizing your house may be one of them. But don’t despair. Step one is to locate a Financial professional.

Here are her top tips for taking charge of your future fortunes:

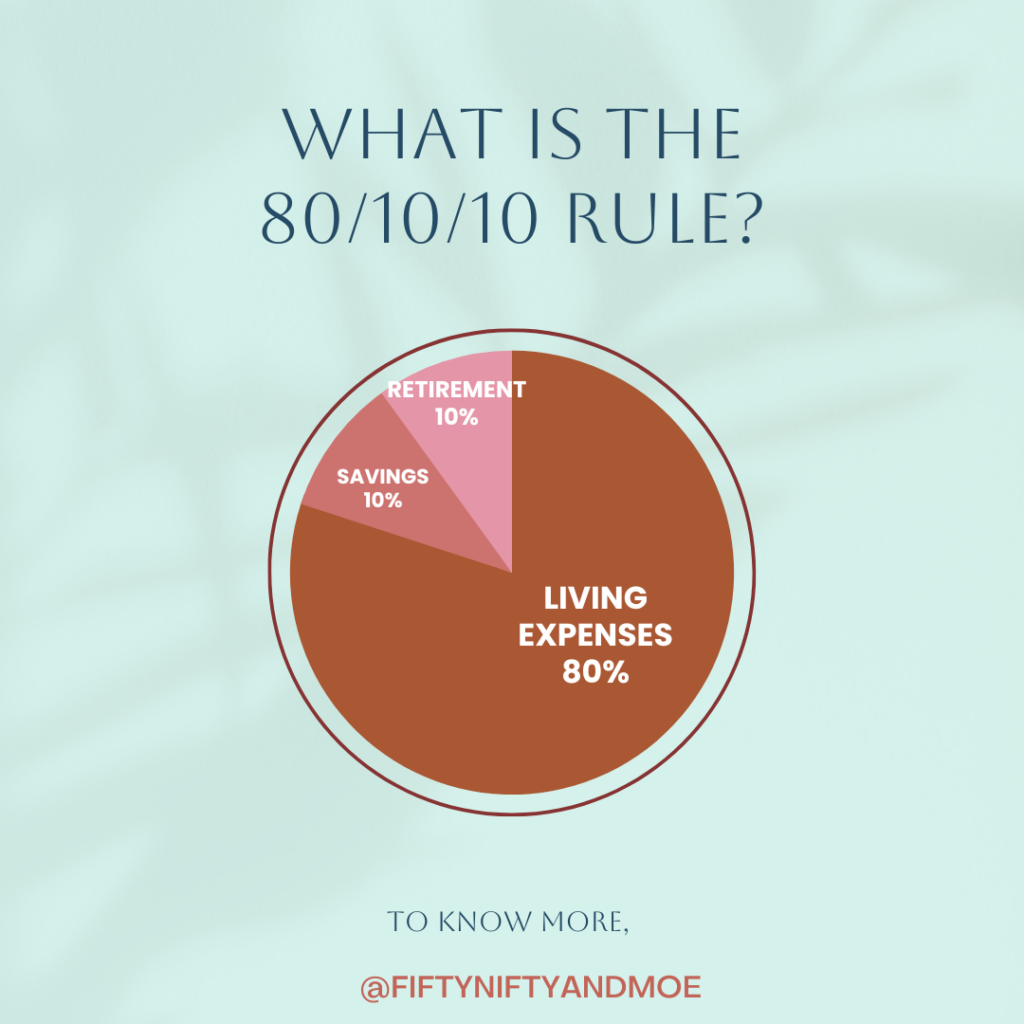

1 -LEARN THE 80-10-10 RULE.

Picture two circles side by side- Hartman calls these “Mickey Mouse ears.” One of the circles is 80 percent of your income, the maximum that you should spend on your daily living. The other circle is 20 percent, and it’s really two circles of 10 per cent. “The first 10 per cent is what you put into savings, and the other 10 percent is what you need to invest toward retirement,” says Hartman. In the triad of spending, saving, and investing, Hartman says “Investing in products that earn compound interest is what gives your money wings. Our parents’ generation knew that squirreling away a few dollars every week was a good thing, and they were so right. Having a set amount to save every month is forward thinking.”

She explains that how and when you invest is shaped by many things: your age, goals, risk tolerance, status. The good news: never too early, and never too late to start.

2 – INTERVIEW PROACTIVELY.

“When you shop for your financial professional the way you would shop for a daycare center for your baby, because your money is your baby, and you want her to grow big and strong,” says Hartman. Ask very pointed questions. Check in every corner. Look under things, Open closets and cupboards, metaphorically speaking. Does it smell right? If you feel uncomfortable in this role, bring along someone who is especially confident and assertive as your advocate and co-pilot.

3 – UNDERSTAND THE DEFINITION OF “FIDUCIARY.”

Some financial institutions are fiduciaries. Some are not. You want the ones that ARE. A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties. In simple terms, this means that a fiduciary will always act in your best interest, even when doing so is not necessarily in the best interest of themselves or their firm.

Kinda shocking, right? Hartman agrees. “What you have to remember is that financial institutions are just like medical plan carriers and hospitals, and CFPs are like doctors. They support certain products, and they will promote the products from which they have a relationship– in other words, those that give them a kickback. There may be 25 blood-pressure medications, and your doctors will recommend the one they support, meaning that they get a little something for it. This is disturbing, so when we’re dealing with money, insist on a fiduciary, who will recommend a course of action which is actually best for you, because they have a legal responsibility to do so.”

So, wouldn’t this just be a given? Nope. “It’s possible for the company to be a fiduciary, but for the individual agent to not be a fiduciary,” says Hartman. “Assume nothing. There are well-intentioned companies and individuals who will always do the right thing by you, even if they are not fiduciaries. But it’s a risk you shouldn’t take unknowingly.”

4 – UNDERSTAND THE DIFFERENCE BETWEEN SIMPLE AND COMPOUND INTEREST.

Interest is a fee a borrower pays to the lender for a loan. Simple interest is a fixed amount (percentage) of the loan amount paid over a specified time. Think mortgage, car note, personal loans. Compound interest Iis a different animal. Compound interest increases and accumulates with other interest amounts. Basically, the borrower pays interest on interest (!) along with the principal, or loan amount.

“When you deposit cash in the bank, the bank pays simple interest. But when you borrow money, the bank calculates the loan, meaning what they charge you, at compound interest, of course!” says Hartman.

5 – FORGET ABOUT SOCIAL SECURITY BEING YOUR ONLY SAFETY NET.

This one is a bitter pill to swallow. Most of us grew up thinking that our Social Security would be there to take care of us like an old friend or a dutiful child when we hang up our dancing shoes. Not so; Social Security was actually never intended to be a retired person’s only source of income. This realization further exposes the deep-seated nature of privilege, often white privilege. It’s based on the underlying assumption that older people naturally have passive income from investments, real estate, long-standing business arrangements, and from the nourishing flow of inherited familial wealth. Fewer and fewer people of any complexion actually have these assets today.

Hartman questions the common wisdom of waiting as long as possible before filing for Social Security benefits. “Delayed gratification is a good skill to develop,” she says. “But I’m not 100 percent behind waiting it out. First, remember that tomorrow is not promised. And know that the difference in the pay-out year to year may not be significant, so you may be wise to just call it a day and get that money!”

She also cautions against assuming that your spouse’s Social Security benefits will automatically come to you when your spouse passes. “This can be a shocking wakeup call,” she says. “Let’s say your husband worked for 45 years, and let’s say that you did, too. Then your spouse passes, and you naturally expect to collect his benefits as the survivor. If your earnings were past a certain threshold, you don’t qualify to receive his benefits, and all those dollars he accrued during many decades of hard work just go back into the government’s pot.”

It’s important to understand that Social Security is not static. It’s a moving target. The thresholds change often, so keep yourself informed. And if your history of earning, spending, saving and investing is less than perfect, don’t torture yourself with the old woulda-coulda-shoulda. Start interviewing CFPs today, and begin building your future. Because after all, your future begins right now!

#

Be the first to comment